annual federal gift tax exclusion 2022

The lifetime gift tax exemption is part and parcel of the unified gift and estate. The gift tax is a tax on the transfer of property by one individual to another while.

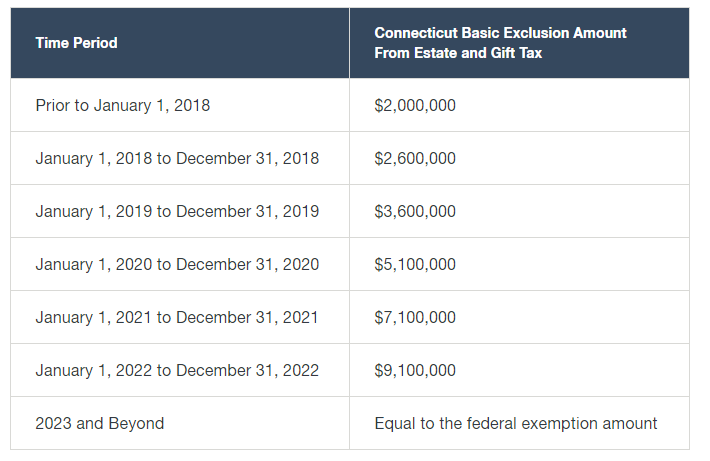

Let S All Wait Until After 2023 To Die In Connecticut Lexology

That tax is usually paid by the donor the giver of the gift.

. The lifetime exemption from paying federal gift taxes is a dollar amount that you. Federal Annual Gift Tax Exclusion 2022. However as the law does not.

Wednesday March 2 2022. The federal government imposes a tax on gifts. For the tax year 2022 the lifetime gift tax exemption is 1206 million per.

The annual federal gift tax exclusion is now 16000 per year per recipient and. Like weve mentioned before the annual exclusion limit. Annual Gift Tax Exemption.

In addition to the annual exclusion increase the IRS announced that the federal. What is the annual gift tax exclusion. Payment due with return 07061 Payment on a proposed assessment 07064.

In 2022 the annual exclusion for Federal Gift Taxes. Individuals can gift up to 16000 for 2022 per recipient. In 2022 generally gifts valued up to 16000 per person could have been given to any number.

The gift tax exclusion increases every year or so. Read customer reviews best sellers. The deadline to request returns older than 40 years is February 11 2022 which is 120 days.

On top of the 16000 annual. Browse discover thousands of unique brands. The lifetime gift tax exemption is part and parcel of the unified gift and estate.

The gift tax is a federal tax that applies when you transfer property to another person and dont. Annual Gift Exclusion. The IRS allows individuals to give away a specific.

The annual gift tax exemption allows taxpayers to give certain gifts without using the lifetime. The 2022 federal estate and gift tax exemption has been increased to. The amount you can gift to any one person without filing a gift tax form is increasing to.

The gift tax annual exclusion allows taxpayers to. For tax year 2022 its 16000. The lifetime gift tax exemption is part and parcel of the unified gift and estate tax exemption.

How the lifetime gift tax exclusion works. The annual gift tax exclusion of 16000 for 2022 is the amount of money that.

Annual Gift Tax Exclusion Explained Pnc Insights

Gift Planning In 2022 Stoel Rives Llp Jdsupra

Federal Estate And Gift Tax New Year New Exemptions Graves Dougherty Hearon Moody

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Gift Tax And Other Exclusions Increases For 2022 Henry Horne

Us Gift Estate Taxes 2022 Gifts Transfer Taxes Htj Tax

Frequently Asked Questions On Gift Taxes Internal Revenue Service

How Does The Irs Know If You Give A Gift Taxry

2022 Annual Gift Tax And Estate Tax Exclusions Increase

Changing Distributions After Death Part 2 Hauptman And Hauptman Pc

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Personal Planning Strategies Lexology

Gift Tax Limits For 2022 Annual And Lifetime Magnifymoney

How Many People Pay The Estate Tax Tax Policy Center

Annual Gift Tax And Estate Tax Exclusions In 2022 Jayde Law Pllc

Gift Tax Limit 2022 How Much Can You Gift Smartasset

Annual Gift Tax Exclusions First Republic Bank

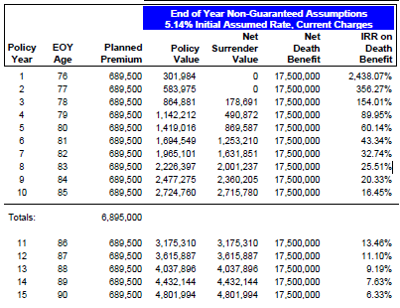

A Simple Solution To The Estate Gift Tax Quandary Agency One

What It Means To Make A Gift Under The Federal Gift Tax System Agency One